Pocket Neighborhoods

Pocket neighborhoods offer investors an opportunity to tap into the growing demand for sustainable communities, the market is small for now and there may be challenges in finding suitable sites and obtaining financing.

Benefits

As an investor, pocket neighborhoods offer the benefit of a strong sense of community, which is a major draw for potential residents. In today’s fast-paced world, people are looking for ways to feel connected and supported by those around them, and pocket neighborhoods offer just that. This sense of community and neighborly living can have a positive impact on residents’ mental health and emotional well-being, making it an attractive option for people of all ages. From seniors aging in place to young families, the community support in pocket neighborhoods makes life less stressful and more enjoyable, which can lead to high demand and potentially strong returns on investment.

Market Opportunity

The market for pocket neighborhoods is relatively small compared to the overall housing market, but it is growing. According to a report by the National Association of Home Builders (NAHB), pocket neighborhoods represent a small but growing segment of the housing market, with an estimated 500-1,000 pocket neighborhoods built or under construction in the United States as of 2021.

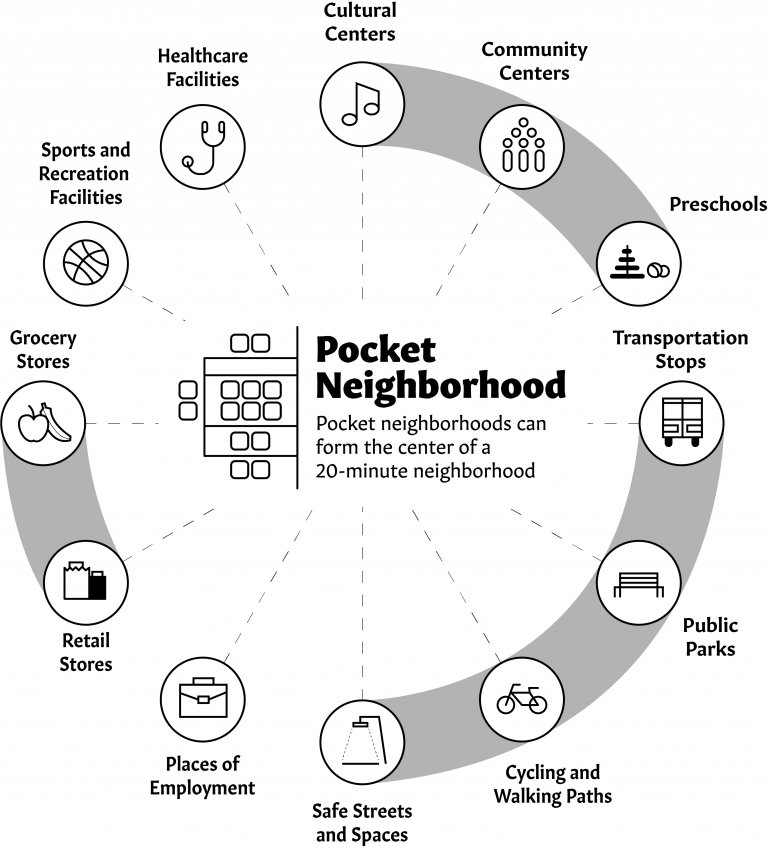

The demand for pocket neighborhoods is driven by a variety of factors, including a growing interest in walkable, sustainable communities, a desire for social connectedness and community-building, and a need for affordable housing options in certain markets. However, we this as an asset that will serve, millennials, baby boomers, and seniors. Millennials believe in sustainability and want to live in places that cater to those needs. Baby boomers want to downsize for a simpler life and due to the lack of and extreme prices for senior living facilities to would be a great alternative.

Business Model

The homes in the pocket neighborhoods have a smaller footprint, typically ranging from 250 to 500 square feet, which is significantly smaller than the average new American house that spans around 2,400 square feet. These homes are expected to be affordably priced, with estimated costs falling within the range of $100,000 to $125,000.

The business model of a pocket neighborhood typically involves purchasing a suitable site and developing a small community of homes or apartments designed to encourage social interaction and a sense of community among residents. The developer may design the neighborhood themselves or hire an architect and other professionals to create a cohesive design that fits with the surrounding community and meets the needs of potential residents.

An investor can purchase a pocket neighborhood in a variety of ways, including purchasing an existing development from another investor or developing a new pocket neighborhood from scratch. The process typically involves identifying a suitable site, obtaining necessary permits and approvals, designing and building the homes or apartments, and marketing and selling or leasing the units to potential residents.

Returns

The returns that can be expected from a pocket neighborhood investment depend on a variety of factors, including location, demand, development costs, and marketing strategy. Pocket neighborhoods are often designed to be more affordable than traditional housing developments, which may help attract buyers or renters looking for affordable, sustainable housing options. However, investors may need to prioritize social impact and community-building over financial returns in order to make a pocket neighborhood investment successful.

Factors that can impact returns on a pocket neighborhood investment include the cost of land and construction, the design and amenities of the development, local market conditions, and the overall economic climate. Additionally, the success of a pocket neighborhood investment may depend on factors such as effective marketing and community outreach, building strong relationships with local officials and community members, and creating a sense of community and social connectedness among residents.

Expenses

Investors in pocket neighborhoods must account for a variety of expenses. Here are some of the key expenses an investor may need to consider:

1. Land acquisition costs: Investors will need to purchase land for their pocket neighborhood development, which can be a significant expense depending on the location and size of the site.

2. Construction and development costs: Investors will need to pay for the construction of the homes or apartments, as well as any shared amenities such as a common courtyard or community garden. This can include expenses such as materials, labor, permits, and inspections.

3. Marketing and sales expenses: Investors will need to promote their pocket neighborhood development to potential buyers or renters, which can include expenses such as advertising, staging, and real estate commissions.

4. Financing costs: Investors may need to obtain financing for their pocket neighborhood development, which can include expenses such as interest payments, loan origination fees, and other financing costs.

5. Ongoing maintenance and management costs: Once the pocket neighborhood is developed, investors will need to account for ongoing expenses such as property taxes, insurance, maintenance, and management costs.

6. Unexpected expenses: There may be unexpected expenses that arise during the development process or after the pocket neighborhood is completed, such as repairs or legal fees.

It’s important for investors to carefully analyze these expenses and develop a comprehensive budget before making a decision to invest in a pocket neighborhood. By accounting for all potential expenses and risks, investors can make informed decisions and maximize their chances for success.

Where to Buy Pocket Neighborhood

Are you looking to invest in a pocket neighborhood or simply interested in living in one? Start your search by visiting real estate websites like www.trovit.com and search for “Ross Chapin,” a renowned pocket neighborhood architect. While most of the results will be individual houses, you may find an occasional home located in a pocket neighborhood. For those specifically looking for existing homes for sale in Seattle’s pocket neighborhoods, be sure to check out The Cottage Company’s list of available homes. Their selection may just include your perfect pocket neighborhood home.

Finding a Developer

If you’re looking for a developer to build a pocket neighborhood, there are several ways to find one. One option is to start by contacting your city planner, who may be able to provide a list of developers or organizations that focus on smart growth and sustainable development. You can also search online for organizations such as The Congress for the New Urbanism or local green-building associations, which may have directories or resources for finding developers. Additionally, you can partner with a developer to locate a home on a large lot, subdivide the lot, rehab the existing home, and build additional homes, but it’s critical to understand the zoning regulations for the land.

Resources

cnu.org

pocket-neighborhoods.net

Pocket Neighborhoods Book

Zoning

Zoning is an issue for pocket neighborhoods. Zoning laws, regulations, and policies in cities across the nation can be restrictive and limit the development of pocket neighborhoods. Building codes and local regulations may be too restrictive, making development difficult or impossible, while finding land that is zoned for high-density development can be a challenge. In addition, permit costs, utility costs, and infrastructure requirements can drive up development costs, and some areas may require attached garages or other costly features. Cities with more progressive and reasonable planning departments, like Portland and Seattle, may have better building codes and policies that encourage sustainable development. Pushing for better housing policies and using land more efficiently could help encourage the development of pocket neighborhoods.